The IPO Process in India: A Handbook

Table of Contents

To the corporations seeking access to growth, legitimacy, and access to massive capital, an Initial Public Offering (IPO) is the money-maker. However, becoming a public company listed on India’s share market is a step-by-step process of meticulous planning, following rules, and scripted action. This handbook guides you through the IPO process in India from decision to listing.

Why Firms Do an IPO

It is fascinating to know why firms go out and issue new stock without going first through the IPO:

- Growth Capital: In raising enormous amounts of capital in attempting to grow the firm, firms, or paying off debt without taking on financial leverage. It also gives firms economic clout to buy other companies, invest in new technologies, or expansion globally. Growth Capital.

- Improved Visibility and Credit Rating**: Exchange listing strongly enhances customer confidence, market reputation, and firm visibility. It most often results in improved media image, positive brand reputation, and improved supply relationship.

- Shareholder Cashability: Permits existing shareholders, such as founders, staff, and initial investors, the potential to sell some or all of their share value.

- Access to Future Capital:Offers the opportunity to access money in the future through follow-on public issues, rights issues, or debt issues, and hence possessing an ever-available source of funds to fund future growth.

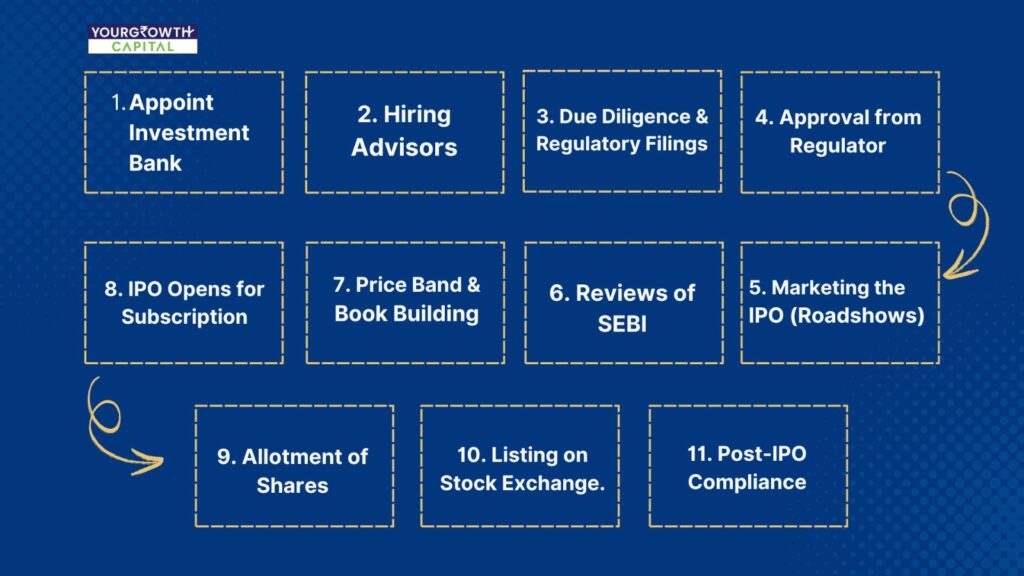

Important IPO Process Steps in India

1. Strategic Choice and Preparation Internally

The IPO process begins with the board and management of the company taking a strategy decision to go for an IPO. It is primarily driven by competitiveness, performance, market situation, and long-term strategic incentives. Firms need to assess their operational maturity, financial strength, and marketability before going in this direction.

2. Appointment of Intermediaries

A team of financial, legal, and regulatory experts need to guide the company through the intricate IPO process:

- Lead Managers (Merchant Bankers): Oversee the IPO process, conduct due diligence, offer document preparation, and marketing. Also determine the issue price and negotiate with regulatory authorities.

- Legal Advisors: Confirm that the company meets all the regulatory conditions, aid in preparing the prospectus, and take away the ambit of any legal problems.

- Auditors: Project the accounts of the company in clear and uncluttered format, a necessity in creating investor confidence.

- Transfer Agents and Registrars: Impres the application and allotment to facilitate smooth and easy transactions between retail and institutional investors.

3. Due Diligence and Preparation of DRHP

There is colossal due diligence in judging the financial, operational, and legal health of the company. It includes reading the financial statements, due diligence of the promoters, reading legal disclosures, and testing of internal control. Then, a Draft Red Herring Prospectus (DRHP) is prepared with prominent facts like financial statements, business risks, background of the management, and use of IPO proceeds. It is one of the key communication documents portraying the picture of the business model of the company as well as future growth prospects to prospective investors.

4. Filing with SEBI

The DRHP is submitted to the SEBI for scrutiny. SEBI verifies the document for fair and equitable disclosure to the investor interest. The procedure involves a series of interactions with SEBI, in which the regulator seeks further clarification, or attempts to modify the draft.

5. Stock Exchange Filing and ROC Submission

When the company gets SEBI approval, it makes a final Red Herring Prospectus (RHP) with the Registrar of Companies (ROC). It also makes a listing application with key stock exchanges such as the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). It entails adherence to listing norms of selected stock exchanges, for example, improved corporate governance and disclosure fiscal needs.

6. IPO Marketing

Mass investor meetings and roadshows are done by the firms to generate interest and credibility into the issue. It is an important exercise in the back end of generating momentum and attracting institutional and retail investors. Fund manager presentations, retail investor presentations, and media presentations may even be arranged in some instances, highlighting the firm’s business model, numbers, and growth strategy.

7. Pricing the Issue

Pricing can be done using the book-building technique, where the price is fixed in a band and the final price will be determined based on investor demand. The process is flexible enough to enable the issuer to negotiate and price most favorably based on market mood.

8. Opening the IPO for Subscription

After the price is determined, the IPO becomes available for subscription, usually for 3-5 working days. The subscription is through Bank, broker websites or ASBA facilities. The window period is usually marked by increased trading volumes and media coverage, a sign of interest from the investors.

9. Share Allotment and Refunds

During and after the subscription period, the shares are allocated among the subscribers based on demand and as under rules. Oversubscription would typically be succeeded by allotment on pro-rata or lottery basis, and refund of non-allotted shares. Closure of basis of allotment and crediting of the shares in successful applicants’ demat accounts also come in this phase.

10. Listing and Commencement of Trading

Lastly, the company’s parent shares are floated in the selected exchanges, de facto bringing the firm’s shares to the market. Listing day is also a spectacle, a first response of the market to the firm and generally a pointer towards its share’s trend in secondary market performance.

IPO Structure in India

The IPO procedure in India is governed by a strong regulatory regime for investor protection and transparency:

- SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

- Companies Act, 2013

- Listing Obligations and Disclosure Requirements (LODR) Regulations

All of them require rigorous disclosures, corporate governance standards, and list-based reporting from time to time.

An IPO and going public is a life-altering experience that can free tremendous value for a company. Proper preparation, guidance, and planning can guide companies through the process to growth and market domination. It is a challenging but rewarding process that gives companies the money and market exposure they need to succeed in the long term.